When you first go into business for yourself, it’s not always easy to know what to expect. Because there’s a lot that you have to take on and do alone! Sometimes, it’s a blessing in disguise for you not to know about this, because it may put you off from getting started in the first place. But at the same time, it can be handy to be prepared.

This is a contributed post. Please refer to my disclosure for more information.

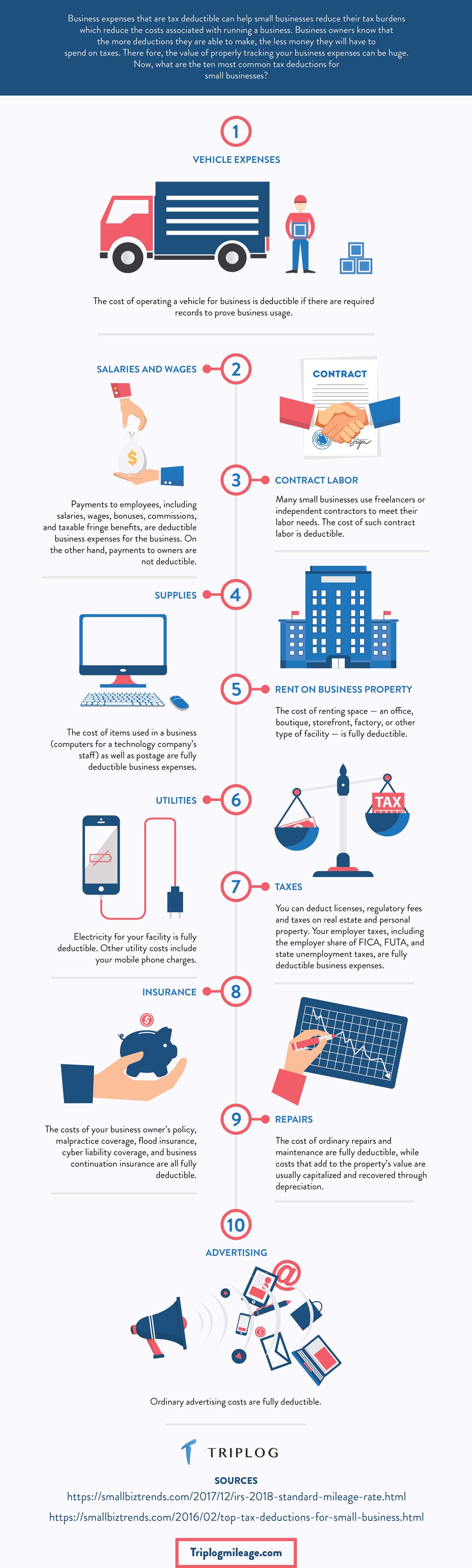

Whether you’re looking to start a business or you’re already up and running, business expenses are a key part of running a company. So to help you out, here are a few things you need to know.

1. How To Record

First of all, you need to make sure that you’re keeping an accurate record of your business expenses. If you just go about your business, spending without thinking, it’s going to be hard for you to remember everything when it comes to processing your taxes. So you will need to record what you spend in some way, like in a spreadsheet or using a tracking app.

2. What To Record

But you may also wonder exactly what you need to keep a record of. In short, it can be anything that is a cost to run your business. These could include your property rent, utility costs, vehicle running costs, insurances, and supplies.

For more information, take a look at the infographic below that details the ten most common tax deductions for small business.

What To Read Next

Is This Common Problem Preventing You From Starting Your Dream Business?

Starting an online business soon? Here are my predictions for how to succeed in 2018